ANREV and INREV aim to improve transparency and promote best practice and professionalism in the non-listed real estate industry. INREV and ANREV members have stimulated and strongly supported the establishment of industry guidelines over the past few years. INREV has developed an integrated set of principles and recommendations including tools and examples for governance and information provision for fund managers and investors of non-listed real estate vehicles.

INREV Guidelines Objectives

The objectives of the INREV Guidelines are:

- To establish requirements and best practices within the sector and to help managers implement them in practice;

- To ensure that investors in non-listed real estate vehicles obtain consistent, understandable, easily accessible and reliable information that can be compared across investments and between different periods.

The INREV Guidelines are presented in an online format, allowing visitors to easily navigate and search through and create specific customised guidelines. The guidelines are primarily tailored towards non-listed real estate funds, but further guidance applicable to specific investment vehicles will be added over time.

CLICK HERE to create a custom version module by module in a PDF format in our Guidelines section.

INREV Guidelines Modules

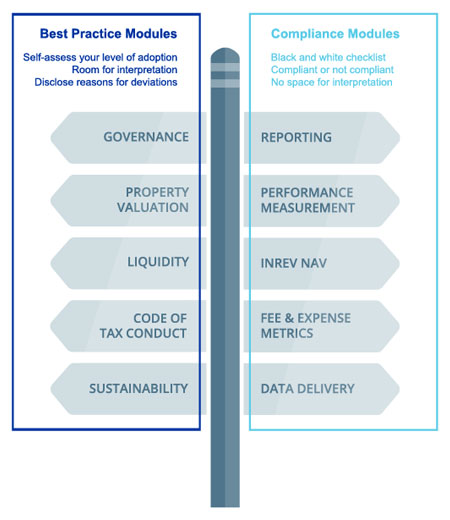

The INREV guidelines are organised into 10 modules as follows:

The Guidelines are embedded in an Adoption and Compliance Framework which allows managers and investors to evaluate their implementation of the INREV Guidelines, module by module. To determine ways of implementation and add a hierarchy to the guidelines’ requirements and best practices it is important to understand the underlying terminology:

If you have any questions, please contact [email protected] or phone +852 3108 2790.

-

Principles serve as a basis for the requirements and best practices.

-

Best practices have been developed by INREV to enable investors and managers to design vehicle products with an effective corporate governance framework aligned with industry best practices and at the same time relevant to specific needs. Managers should evaluate themselves against such best practice frameworks and disclose their level of adoption.

-

Requirements are more technical in nature and cannot be individually interpreted but either adhered to or not. The manager’s compliance can be assessed with the help of the INREV Compliance Checklists. Only if all of the requirements for an individual module are fully implemented, the manager can disclose full compliance with that module. If the requirements of a module are not fully met, the manager should disclose that the corresponding module has only been partially complied with, along with the reasons for non-compliance and any additional information relevant to investors’ understanding.

-

Tools and examples are meant to assist in the application of the guidelines. Tools support market participants in assessing specific situations and in complying efficiently with INREV Guidelines and standards. Examples serve as a pattern to be followed by market participants to illustrate a certain standard.

-

INREV proposes definitions (‘INREV Definitions’) to achieve a universal application of terms within the non-listed real estate industry.